tax shelter real estate definition

A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. They work through complex transactions that include.

What Is The Definition Of Tax Shelter Business Interest Expense

A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income.

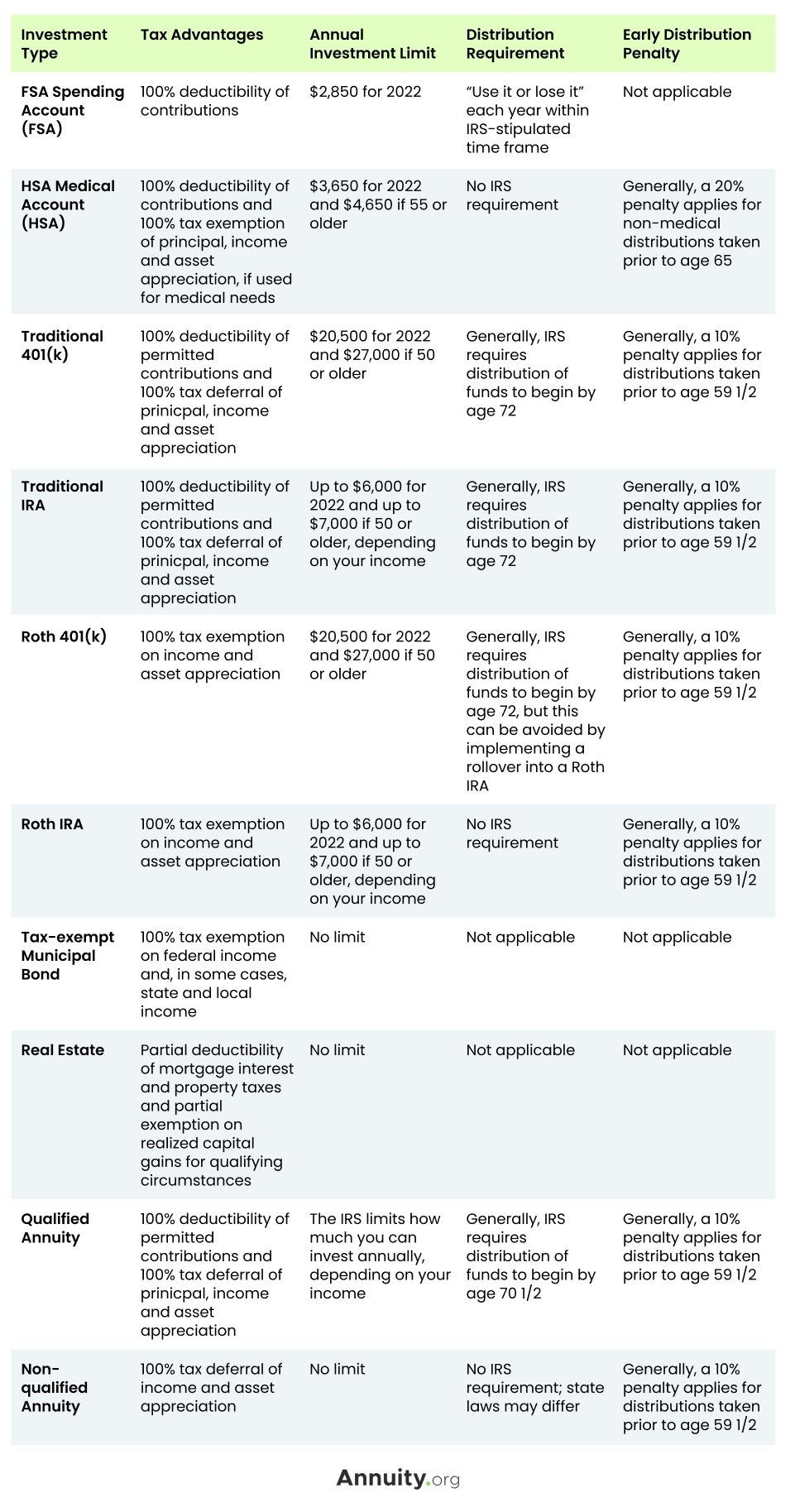

. Here we discuss the types of tax shelters. The most common tax shelter is through such retirement accounts as a 401 k 401 b Roth IRA or a Roth 401 k. The ready to use real estate property has two phases under construction and the other one is the developed phase.

The failure to report a tax shelter identification number has a penalty of. Internal Revenue Code US. A tax shelter is a means of minimizing tax liability.

A tax shelter is entirely different from a tax haven because the latter exists outside the country and its legality. Tax shelters work by reducing your taxable income thereby reducing your taxes. A financial arrangement such as the use of special depletion allowances that reduces taxes on current earnings.

For a married couple filing jointly with a taxable income of 280000 and capital gains of 100000 taxes. Definition of Tax Shelter. The phrase tax shelter is often used as a pejorative term but a tax shelter can be a legal way to reduce tax liabilities.

If your taxable income is 496600 or more the capital gains rate increases to 20. The judicial doctrines have a basic theme. Best Value on the Market.

Tax shelters have therefore often shared an unsavory association with fraud. Common examples of tax shelters are home equity and 401k accounts. 90-Day Access to Our Testing Materials.

In other words it is a type of legal strategy with the help of which an individual can lower their taxable income and hence reduce his or her tax-related liabilities. A number of real estate tax shelter exist. This has been a guide to what is Tax Shelters and its Definition.

In 2022 employees can make up to 20500 in deductible contributions to a 401 k with workers age 50 and older entitled to deduct an additional 6500 in catch-up contributions. Many people think of tax shelters negatively but they are completely legal and legitimate ways to decrease your taxable income. Real estate also benefits from depreciation.

The most widely used tax shelter in the US is the 401k. One of the tax shelters is to invest in real estate but in reality each real estate is a separate entity on its own. CrowdStreet - 185 Average IRR from Real Estate Accredited Investors Only.

75 of the profits andor losses will be allocated to limited entrepreneurs according to the definition. View the definition of Tax Shelter and preview the CENTURY 21 glossary of popular real estate terminology to help along your buying or selling process. An investment vehicle that reduces ones tax liabilityFor example a 401k defers taxation until withdrawal from the account and may therefore be considered a tax shelter.

The real purpose of abusive tax shelters is to lower an investors federal and income tax. How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector. A tax shelter is a method used by businesses and individuals to reduce their tax liabilities.

The IRS allows some tax shelters but. Fundrise - 23 Returns Last Year from Real Estate - Get Started with Just 10. Tax shelter synonyms tax shelter pronunciation tax shelter translation English dictionary definition of tax shelter.

Real Estate Glossary Term Tax Shelter. There is a penalty of 1 of the total amount invested for the failure to register a tax shelter. It is a legal way for individuals to stash their money and avoid getting it taxed.

Tax Shelter A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes maintenance mortgage interest insurance and especially depreciation. A tax shelter is different from a tax haven. A tax shelter is more or less like a financial vehicle through which taxpayers can safeguard their money.

A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes maintenance mortgage interest insurance and especially depreciation. Tax Shelter Law and Legal Definition. Tax shelters are ways individuals and corporations reduce their tax liability.

A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money. Aside from the attempts to stop tax shelters in the United States through provisions of the US. Shelters range from employer-sponsored 401 k programs to overseas bank accounts.

Step Up in Basis Rule Definition. Updated for 2020 Regulations. It can be understood as a financial vehicle or legal strategy or any method applied.

250 Sample Real Estate Exam Questions. Tax shelters are legal unless their sole purpose is to avoid taxes. Other tax shelters include mutual funds municipal bonds.

The abusive tax shelter is a type of investment that is considered illegal as it allegedly diminishes the income tax liability of an investor without affecting the investors income or their assets. The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny in the wake of the proposed Section 163j regulations. A tax shelter is a place to put your money where it will be safe from the long arm of the Tax Man.

Risk Free Pass Guarantee. Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs. Another form of tax shelter is the step up in basis rule.

Tax shelters can be both legal illegal. Courts have several ways to prevent tax sheltering activities from happening. Someone who thinks a feature of the tax code giving.

What Are Tax Sheltered Investments Types Risks Benefits

Tax Shelters For High W 2 Income Every Doctor Must Read This

9 Legal Tax Shelters To Protect Your Money

Tax Shelter Definition Examples Using Deductions

What Is The Definition Of Tax Shelter Business Interest Expense

What Are Tax Shelters Turbotax Tax Tips Videos

What Is The Definition Of Tax Shelter Business Interest Expense

How The Broad Definition Of Tax Shelter Affects Business Interest Deductions And Cash Method Accounting Under New Tax Law Article Refinancing Mortgage Mortgage Letter Gifts

Strolling Penguins And Spectator Free Football Friday S Best Photos Cool Photos Private Equity Free Football

What Is A Tax Shelter And How Does It Work

How The Broad Definition Of Tax Shelter Affects Business Interest Deductions And Cash Method Accounting Under New Tax Law Article Refinancing Mortgage Mortgage Letter Gifts

7 Ways To Create Tax Free Assets And Income

Taking Advantage Of Tax In Real Estate How Physician Investors Win Big

Tax Shield Formula How To Calculate Tax Shield With Example

/GettyImages-88305470-22488417871f4c6b8bd85f13d6766ccc.jpg)

Tax Haven Vs Tax Shelters Is There A Difference

Income Debt And Federal Tax Shelters